The 1990s and 2000s

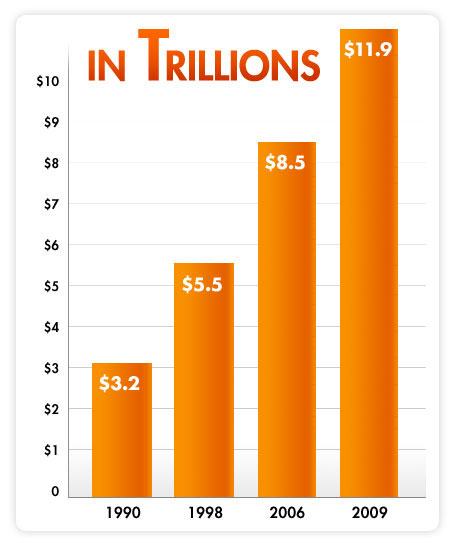

At the beginning of the 1990s, the U.S. economy was still fairly strong. Continued growth in the stock market helped increase the amount of money some people had to spend. It also increased the amount of taxes the Government collected. However, the debt continued to grow.

Starting in 1998, the Government worked to balance its budget. That means it spent no more money than it collected from taxes and other fees. For a short time the amount of debt did not increase a great deal.

But after 2000, changes in Government spending caused the debt to grow again. After the September 11, 2001 terrorist attacks the economy stalled and for a brief time tax receipts slowed. The debt continued to increase due to spending on homeland security, the Iraq war, and programs such as Medicare.

Toward the end of 2007, the U.S., along with many other countries around the world, was in a recession or general slowdown in the economy. To try to encourage the economy to grow again, the Government created and paid for many new programs. It also gave back some of the taxes people had paid. The goal was to get people to spend more money to help the economy grow. The cost of these programs caused the Government’s debt to increase. By 2010, the debt had reached more than $12 trillion.

- 1990 - The U.S. debt continued to grow, despite the strong economy.

- 1998 - The U.S. Government began balancing its budget.

- 2001 - After the terrorist attacks of September 11, 2001, the U.S. economy stalled.

- 2007 - The Government created and paid for new programs to combat the recession and stimulate economic growth.

- 2010 - The debt had reached more than $12 trillion.